The birth and rise of digital currency based on block-chain technology is a disruptive innovation in the field of information technology in the past decade. The first impact it brings to human society is the digital currency represented by Bitcoin, Ethereum and others.

This huge wealth effect has driven millions of investors to use a variety of techniques to “dig” digital money, an activity colloquially known in as “mining.” To harvest as much digital money as possible from the mine, participants need to use equipment as powerful as possible. The device is called a “miner,” and the function is called “mining power.”

- The existing pain spots of two digital currency in mining industry

Of all the digital currency diggers out there, the ones that are best known are Bitcoin, Ethereum, and Filecoin, a new generation of Decentralized Storage Network. In the early stage, for common investors to get involved in mining was to buy their own machines and hand them over to a mining operator (commonly known as a “mine”). In this way, users need to purchase hardware, and need to find a special operator to handle; the whole process is complicated and trivial. Therefore, in recent years, a new way has emerged in the industry.

Large-scale mining campus and operators directly divide the sum of their own mining machine performance (computing power) into unit shares, and users can flexibly buy according to the share, which is called “mining power”. The user buys a piece of mining power and gets the digital currency for the mine campus. This mining power, which minimizes the burden and operation of the user, has been popular since its launch. As a one-stop way for users to participate in the mining, it fully controls the mines and service providers.

However, this mining power service still has the following outstanding problems:

2.1 Users are easily misled by different concepts in the mining process. The needed mining power Filecoin is closely related to but not exclusively based on storage space. Only when the storage space is utilized, valid data is stored; and certain Filecoin is used as pledge, can the storage space be considered as “effective storage mining power”. “Effective mining power” and “storage space” are two related and different concepts. Some service providers sell the “mining power” to users but this is actually “storage space” or “cloud space”. Many users think that the “storage space” or “cloud space” they buy is equivalent to “effective storage mining power”. In fact, without valid data storage, the purchased storage space cannot be counted as “effective storage mining power”, and thus not as Filecoin mining.

2.2 The mining returns are opaque. Users buy mining power, but in many cases, they have no idea of the actual number of nodes or the percentage of mining power. They can only rely on the reference data provided by the service provider.

2.3 Poor liquidity of mining power. Users generally purchase mining power from service providers or platforms. Once the users have bought the mining force, the user hopes to quit midway because of certain reason, while the process of transferring is very troublesome. Some service providers or platforms support the process, but it is only limited to the transfer of mining power between their customers, and it is impossible to allow the transfer of mining power from different service providers. Most service providers or platforms do not even support the process.

2.4 Large capital precipitation and poor financial attributes. After users buy mining power through service providers or platforms, they can only sit back and wait for mining earnings. There is no other way to get more financial services for the precipitation funds and mining power. On the one hand, it can’t make a large amount of precipitation funds be fully utilized. On the other hand, it restricts mining power and liquidity of funds.

- Root cause of three digital currency mining pain spots:

The crux of all these problems is that the institutions, or platforms, that control the sale and service of mining power remain centralized, inherently limiting the openness and transparency of transactions. A major disruptive innovation of block-chain technology is the openness and transparency of bookkeeping and transactions, e.g. the decentralization of business ecology. It is this new form of decentralization that brings openness and transparency to human society and minimizes the cost of building trust in human society. However, the mining of digital currency in the core ecology of the block-chain industry is not transparent, which is undoubtedly a irony.

4 .The DMEX team has proposed a new solution, the DMEX decentralized mining power trading platform. New solution proposed by the DMEX team — DMEX decentralized Mining Power platform.

- How can DMEX solve the pain spots of mining industry with existing mining power?

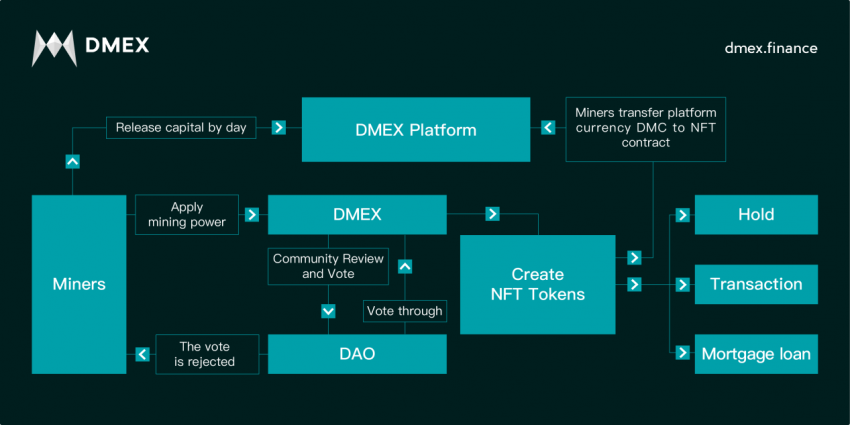

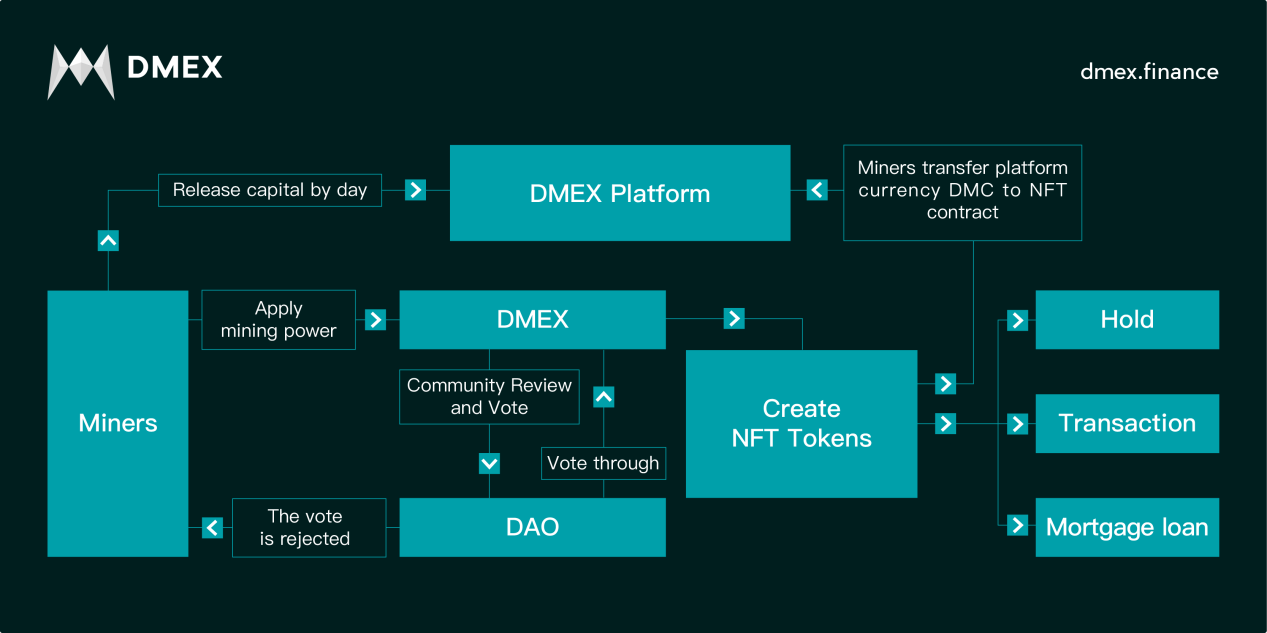

To address this pain spot, the DMEX team proposed the decentralized mining power platform, it is based on Ethereum intelligent contract in the industry. To address the opacity of mining power services provided by existing operators, the DMEX platform writes all key data into the smart Ethereum contract, which automatically distributes the user’s benefits. Intelligent data in a contract cannot be fabricate. There may be no longer worry about grey zone and hidden business trap. At the same time, DMEX will continue to retain and further enhance the existing one-stop user experience, so that users can enjoy thoroughly open, transparent and fair experience.

Martin Wilson has been following the crypto space since 2013. He is a passionate advocate for blockchain technology, and believes that it will have a profound impact on how people live their lives. In addition to being an avid blogger, Martin also enjoys writing about developments in the industry as well as providing useful guides to help those who are new to this exciting frontier of finance and technology.